Here are the top 3 ways to invest in the stock market in detail for a beginner:

- Invest in ETFs: Exchange-Traded Funds (ETFs) are a great way to invest in the stock market for beginners. An ETF is a type of investment fund that tracks the performance of an index, such as the S&P 500 or the NASDAQ. When you invest in an ETF, you’re buying a small piece of the underlying stocks that make up the index it tracks.

ETFs are easy to buy and sell, and they offer diversification across a range of stocks. This means you’re not putting all your eggs in one basket, which can help to reduce your risk. ETFs are also relatively inexpensive, with fees that are typically lower than those of mutual funds.

To get started with investing in ETFs, you’ll need to open a brokerage account with a reputable online broker, such as Fidelity or Vanguard. Once you’ve opened your account, you can search for ETFs that match your investment goals and risk tolerance. Many online brokers offer tools and resources to help you find the right ETFs for your portfolio.

- Invest in Individual Stocks: Another way to invest in the stock market for beginners is to buy individual stocks. This involves researching and selecting specific companies that you believe will perform well in the future. When you buy a stock, you’re buying a share of ownership in the company.

Investing in individual stocks can be more risky than investing in ETFs, as you’re relying on the performance of a single company. However, it can also be more rewarding, as you have the potential to earn higher returns if the company performs well.

To get started with investing in individual stocks, you’ll need to open a brokerage account and research companies that match your investment goals and risk tolerance. It’s important to do your due diligence and analyze the company’s financials, management team, and competitive landscape before investing.

- Invest in Mutual Funds: Mutual funds are a type of investment fund that pool money from multiple investors to purchase a diversified portfolio of stocks. This means you’re investing in a basket of stocks rather than a single company. Mutual funds are a good option for beginners who want to invest in the stock market but don’t have the time or expertise to pick individual stocks.

When you invest in a mutual fund, you’re buying shares in the fund, which is managed by a professional fund manager. The fund manager selects the stocks that make up the portfolio and makes decisions about when to buy and sell them.

To get started with investing in mutual funds, you’ll need to open a brokerage account and research mutual funds that match your investment goals and risk tolerance. It’s important to consider the fees associated with mutual funds, as they can be higher than those of ETFs. Look for mutual funds with low expense ratios, which are the fees charged by the fund to cover its operating expenses.

Order eBook / Paperback Now

Join EngineeringWealth Community

Follow the Author

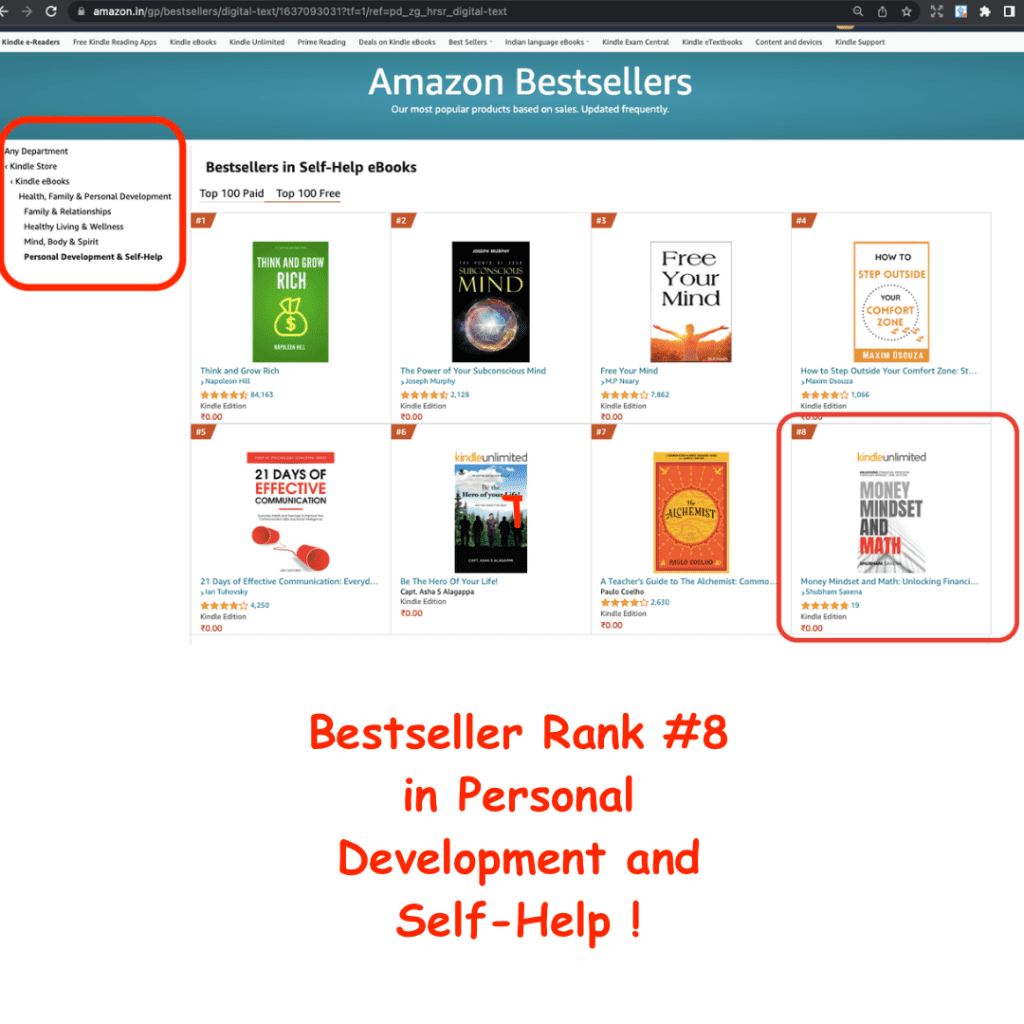

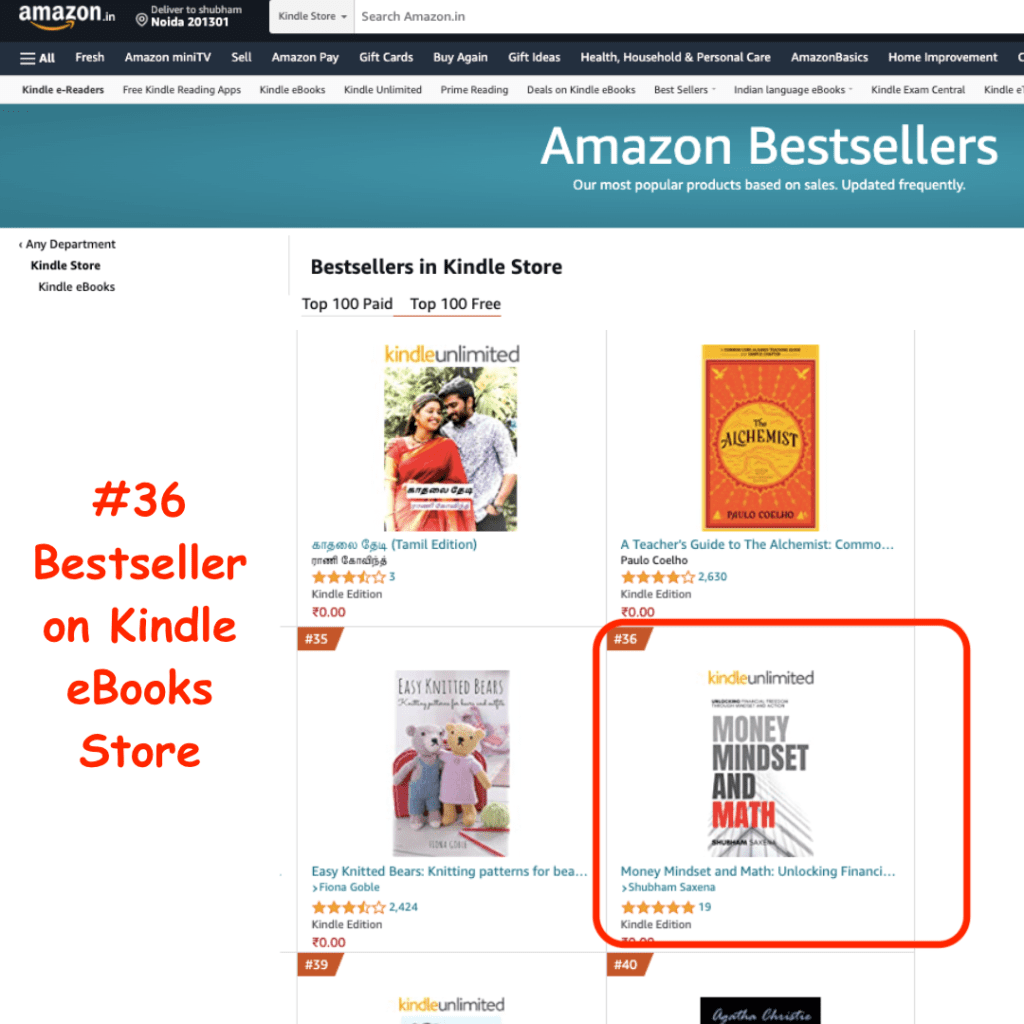

Money Mindset and Math

Engineering Wealth

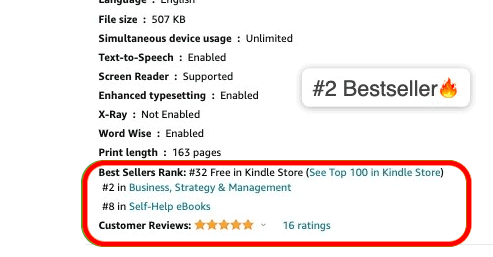

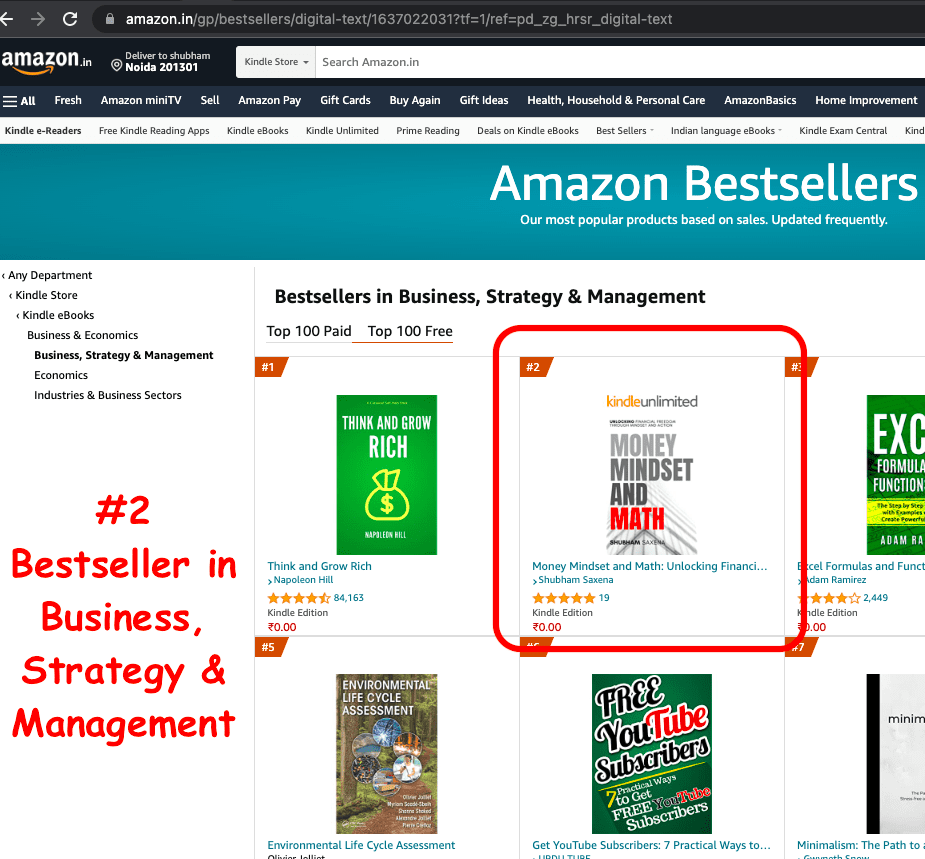

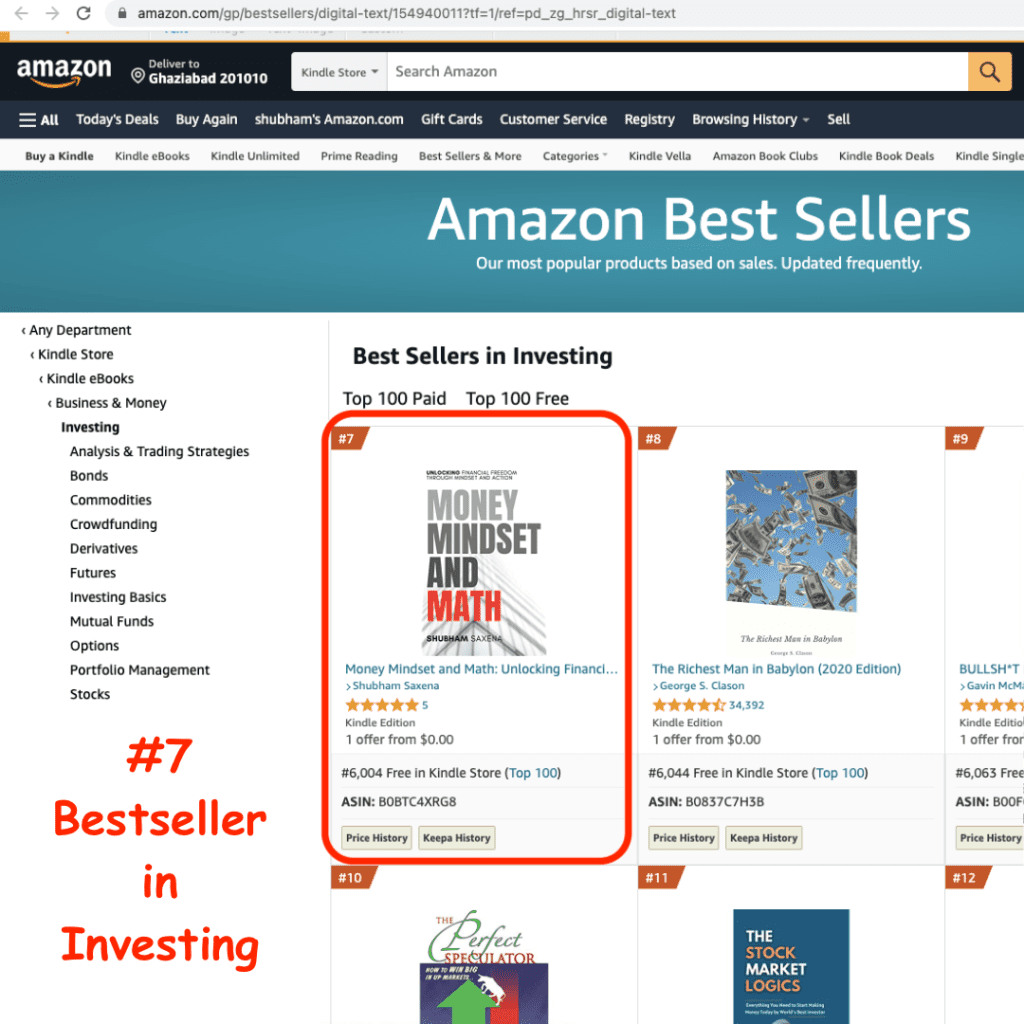

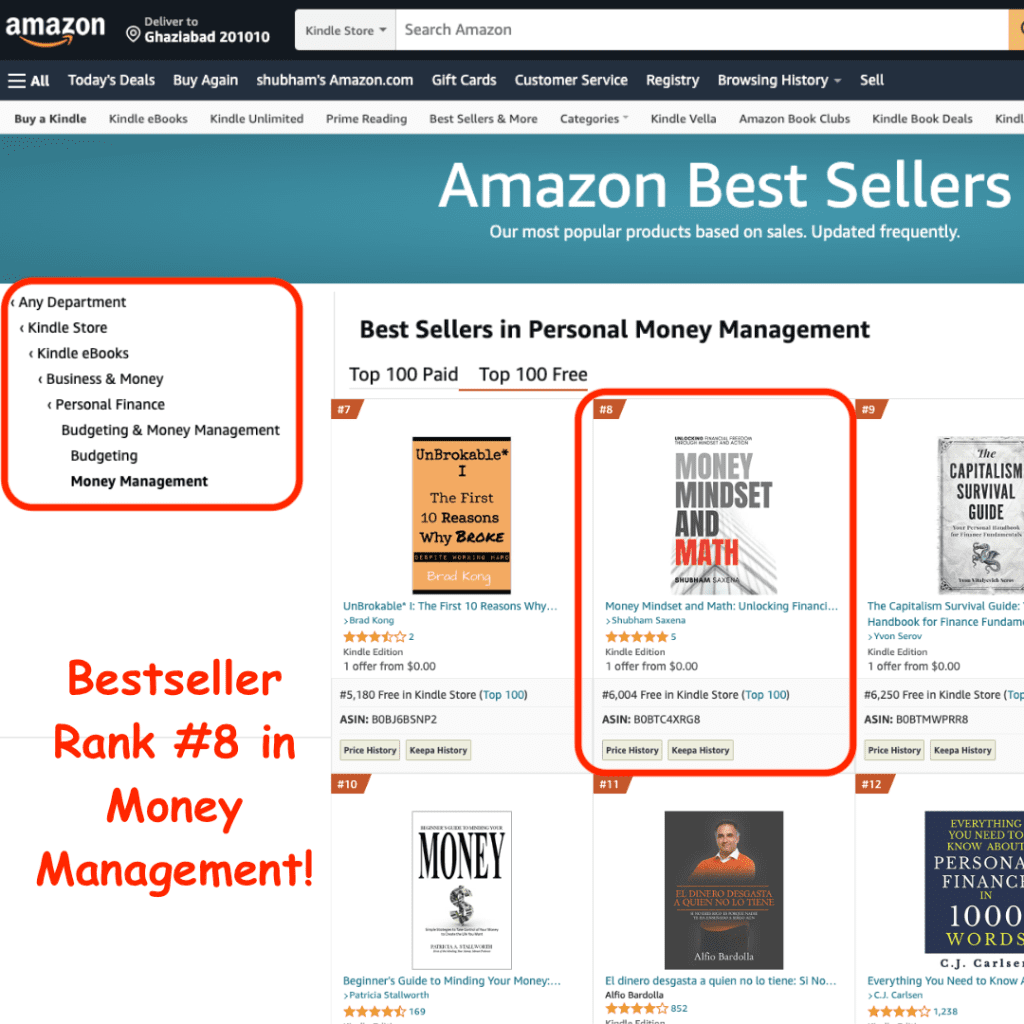

Bestseller book "Money Mindset and Math" by Shubham Saxena

@copyright 2023

Leave a Comment